Image Credit: flickr.com

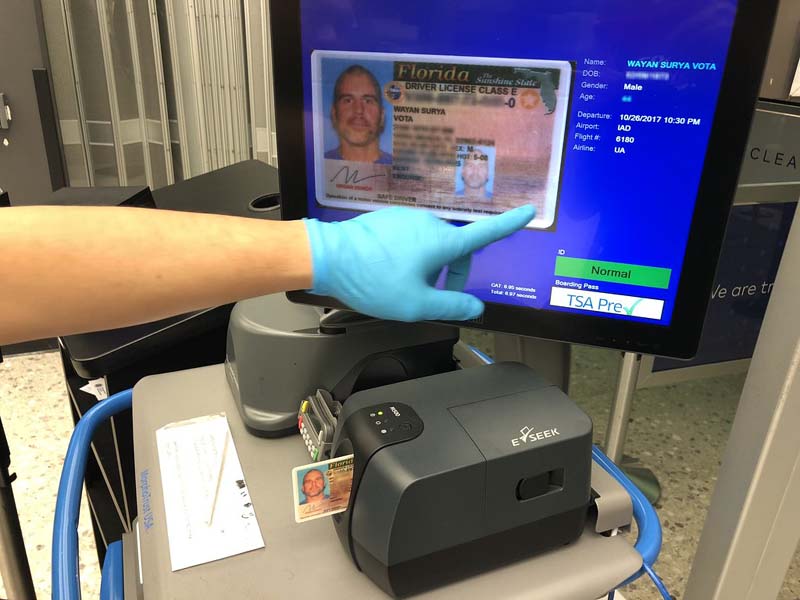

In today’s fast-paced world, the need for efficient and secure document verification has never been more critical. AI-powered ID scanner software is at the forefront of this transformation, enabling businesses to instantly read and extract data from passports, visas, ID cards, and various other identification documents from around the globe. This cutting-edge technology is designed to streamline processes, enhance security, and improve customer service across multiple industries, particularly in sectors that require robust identity verification, such as banking and finance.

One of the primary advantages of AI-based ID scanner solutions is their ability to perform data extraction in real time. Leveraging advanced optical character recognition (OCR) and machine learning algorithms, these systems can accurately capture vital information such as names, dates of birth, and document numbers from various types of identification documents within seconds. This rapid processing not only reduces wait times for customers but also minimizes human error, leading to more reliable data collection and management.

Security is paramount in any identity verification process, and AI-driven ID scanner software provides a robust solution. With on-premise processing capabilities, sensitive data remains within the organization’s infrastructure, significantly reducing the risk of data breaches and unauthorized access. This level of security is particularly relevant for banks and financial institutions, where maintaining customer trust and protecting personal information are essential.

Moreover, the versatility of AI ID scanner software allows it to function on mobile devices, making it an invaluable tool for remote customer service applications. In the era of digital banking, where customers expect seamless and convenient services, the ability to verify identities on-the-go revolutionizes the way institutions interact with clients. Whether in a branch office, at home, or even on a mobile application, customers can provide their identification documents for verification quickly and securely, enhancing the overall client experience.

Implementing AI-powered ID scanner software not only improves operational efficiency and customer satisfaction but also helps organizations remain compliant with regulatory requirements regarding identity verification. As governments and regulatory bodies increase their focus on anti-money laundering (AML) and know your customer (KYC) protocols, businesses must adopt advanced solutions that facilitate quick and accurate identity checks. AI ID scanner technology ensures compliance with these evolving regulations while allowing organizations to focus on their core business operations.

Additionally, the integration of AI in document verification processes can lead to significant cost savings. By automating the data extraction and verification process, organizations can reduce labor costs associated with manual checks and improve overall workflow efficiency. The return on investment from AI-driven solutions can be substantial, as businesses not only save time and resources but also foster better customer relationships through improved service delivery.

In conclusion, AI-powered ID scanner software is paving the way for a new era in document verification. By enabling instantaneous and secure data extraction from a wide range of identification documents, these solutions are transforming operations in various sectors, particularly in banking and financial services. As organizations embrace this technology, they can expect to see enhanced customer satisfaction, improved security measures, and significant operational efficiencies that ultimately drive growth and success in an increasingly competitive marketplace. Embracing AI in document verification is not just a trend—it’s a necessary evolution for any organization looking to thrive in the modern world.